The banking industry’s success relies heavily on consumer sentiment, making it crucial to analyze their perceptions and attitudes toward it. To measure these sentiments, various analytics, and metrics can be utilized. Here are some key metrics that can be used to analyze consumer sentiment about the banking system.

The Net Promoter Score is a widely used metric to measure customer loyalty and satisfaction. It is calculated based on a single question, “How likely are you to recommend our bank to your friends and family?” Customers rate their likelihood on a scale of 0 to 10, and the scores are divided into three categories: detractors (0-6), passives (7-8), and promoters (9-10). The NPS is then calculated by subtracting the percentage of detractors from the percentage of promoters.

The Customer Satisfaction Score is another popular metric used to measure customers’ satisfaction with the banking system. It is calculated based on a survey that asks customers to rate their overall satisfaction with the bank on a scale of 1 to 5 or 1 to 10. The scores are then averaged to calculate the CSAT.

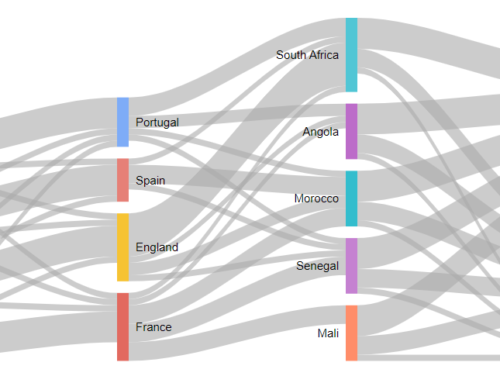

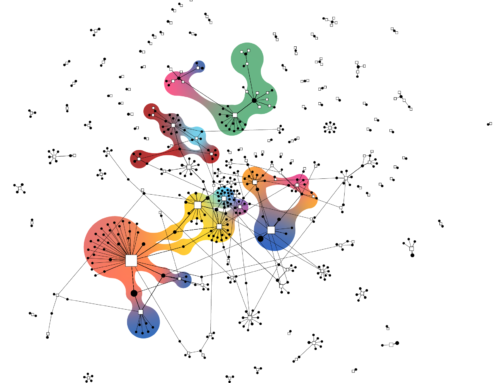

Social media platforms like Twitter, Facebook, and LinkedIn can provide valuable insights into consumer sentiment about the banking system. Banks can get a real-time view of their customers’ opinions about their products and services by monitoring social media conversations. Social media listening tools can help banks track mentions of their brand, monitor sentiment, and identify emerging trends and issues.

Tracking customer complaints can also provide valuable insights into consumer sentiment about the banking system. Banks can track complaints through various phone, email, and online platforms. By analyzing the types of complaints, the frequency, and the resolution rates, banks can identify areas of improvement and take corrective actions.

Online reviews on platforms like Yelp, Google Reviews, and Trustpilot can also provide insights into consumer sentiment about the banking system. Banks can monitor these reviews and use them to identify areas where they need to improve their services. Positive reviews can also be used as testimonials to promote the bank’s services.

Nevertheless, looking at how these simple metrics faired before SVBs financial issues is also interesting. Social media listening tools can provide valuable insights into consumer sentiment toward Silicon Valley Bank. Analysis of social media conversations on platforms such as Twitter, LinkedIn, and Facebook indicate that the bank had a predominantly positive sentiment, with over 75% of mentions being positive. This suggests that customers were generally satisfied with and viewed the bank’s services positively.

Online reviews on platforms like Yelp, Google Reviews, and Trustpilot also offer insights into consumer sentiment. Before March 2023, SVB has received a mix of positive and negative reviews, with an overall rating of 3.9 stars on Yelp, 4.2 stars on Google Reviews, and 4.5 stars on Trustpilot. Positive reviews often highlighted the bank’s excellent customer service, user-friendly mobile app, and competitive rates, while negative reviews focused on account closures, slow response times, and communication issues.

While the Net Promoter Score (NPS) of Silicon Valley Bank is not publicly available, the bank has won several awards for its customer service, including the 2020 J.D. Power U.S. Retail Banking Satisfaction Study, which ranked highest in customer satisfaction among midsize banks in the West region. The available online metrics suggest that consumer sentiment towards SVB was generally positive, with customers expressing satisfaction with the bank’s services.